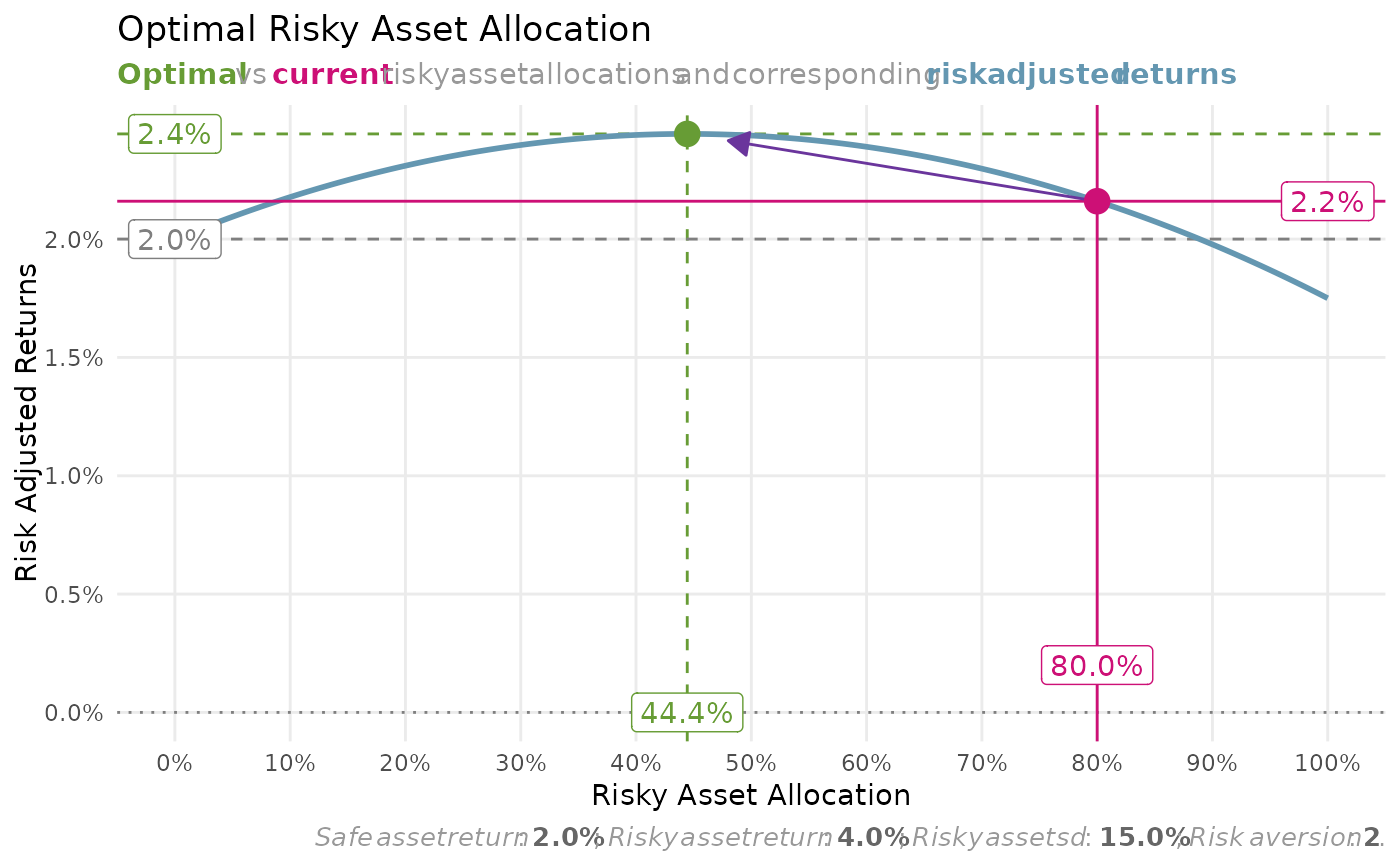

Plots the risk adjusted returns for portfolios of various allocations to the risky asset.

Usage

plot_risk_adjusted_returns(

safe_asset_return,

risky_asset_return_mean,

risky_asset_return_sd,

risk_aversion = 2,

current_risky_asset_allocation = NULL

)Arguments

- safe_asset_return

A numeric. The expected yearly return of the safe asset.

- risky_asset_return_mean

A numeric. The expected (average) yearly return of the risky asset.

- risky_asset_return_sd

A numeric. The standard deviation of the yearly returns of the risky asset.

- risk_aversion

A numeric. The risk aversion coefficient.

- current_risky_asset_allocation

A numeric. The current allocation to the risky asset. For comparison with the optimal allocation.

Value

A ggplot2::ggplot() object.