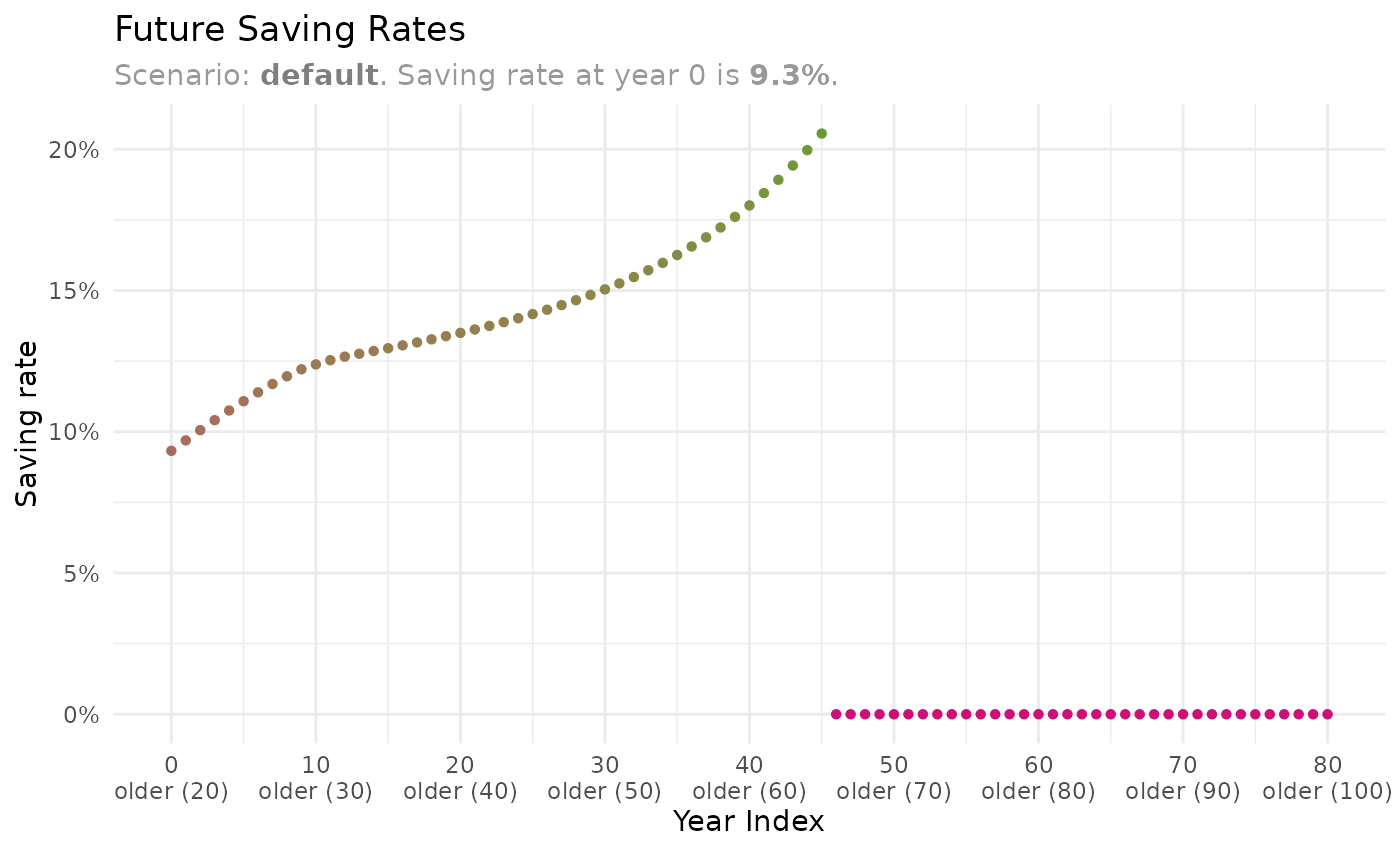

This function plots the future saving rates from a scenario object.

Arguments

- scenario

A

tibblewith nested columns - the result ofsimulate_scenario(). Data for a single scenario.- aggregation_function

A function used to aggregate the saving rates for multiple Monte Carlo samples. Default is

median. IfNULL, no aggregation is performed.- y_limits

A numeric vector of two values. Y-axis limits.

Value

A ggplot2::ggplot() object.

Examples

older_member <- HouseholdMember$new(

name = "older",

birth_date = "2000-02-15",

mode = 80,

dispersion = 10

)

household <- Household$new()

household$add_member(older_member)

household$expected_income <- list(

"income" = c(

"members$older$age <= 65 ~ 10000 * 12"

)

)

household$expected_spending <- list(

"spending" = c(

"TRUE ~ 5000 * 12"

)

)

portfolio <- create_portfolio_template()

portfolio$accounts$taxable <- c(10000, 30000)

portfolio$weights$human_capital <- c(0.2, 0.8)

portfolio$weights$liabilities <- c(0.1, 0.9)

portfolio <-

portfolio |>

calc_effective_tax_rate(

tax_rate_ltcg = 0.20,

tax_rate_ordinary_income = 0.40

)

scenario <-

simulate_scenario(

household = household,

portfolio = portfolio,

current_date = "2020-07-15"

)

#> Warning: no DISPLAY variable so Tk is not available

#>

#> ── Simulating scenario: default

#> ℹ Current date: 2020-07-15

#> ! Caching is NOT enabled.

#> → Simulating scenario based on expected returns (sample_id == 0)

plot_future_saving_rates(scenario)